Create an all-in-one benefits solution to engage and retain employees

Our comprehensive employee benefits platform not only helps you build your employee experience but also streamlines your HR admin, meaning less time spent sorting through all your benefits and more time on the things that matter.

Simplify your benefits solution

Show your people all the amazing employee benefits you offer in one centralised, branded platform.

Create a happy and engaged team

Enhance employees' wellbeing with access to their benefits, discounts and wellness centre.

Drive ongoing engagement

Understand which employee benefits your team use and drive retention through valuable data.

A platform that empowers your people

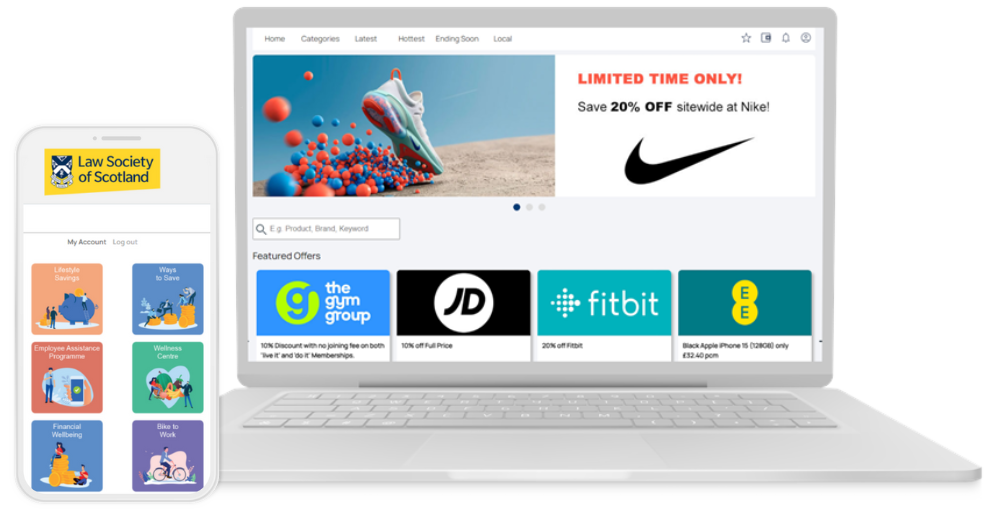

Customisable employee benefits platform

Minimise everyday HR admin with a streamlined, user-friendly employee benefits platform that gives you the freedom to bring your existing company’s benefits and perks into your own customisable and branded hub – giving you that personal touch.

You can also access additional products, such as GP & EAP Helpline to look after your employees' wellbeing or Health Cash Plan to help them effectively manage their healthcare expenses - all to compliment your existing benefits.

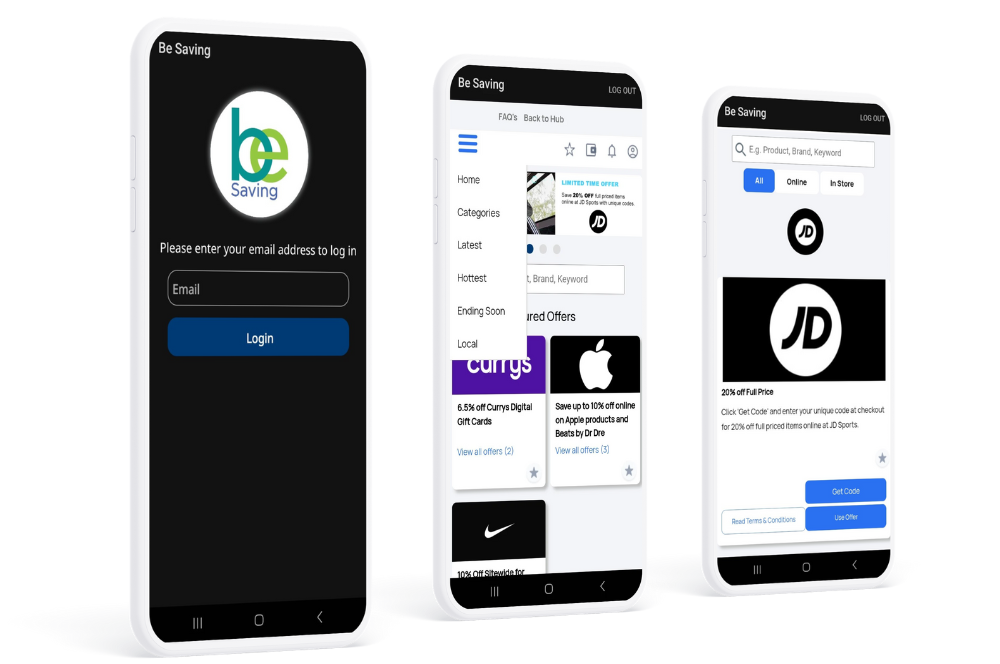

Be Saving App

Now you can access all your employee benefits conveniently from our Be Saving mobile app, available on Android and iPhone. Access your company's benefits, the wellness centre, as well as everyday savings and discounts for a seamless employee engagement experience on the go.

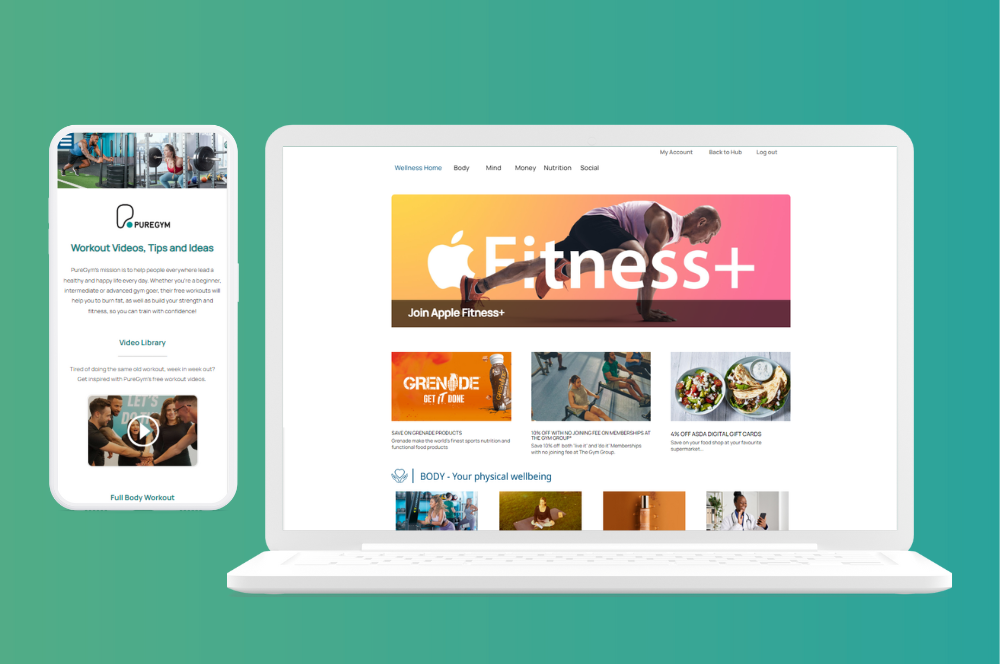

Wellness Centre

Ensure your people’s wellbeing is always looked after with access to our Wellness Centre, where your team can read expert guides on physical, mental and financial wellbeing - all conveniently located in a single, accessible hub. Prioritise the wellbeing of your team and reap the rewards of a healthier, happier and more productive workplace.

Support employees' financial wellbeing with lifestyle savings

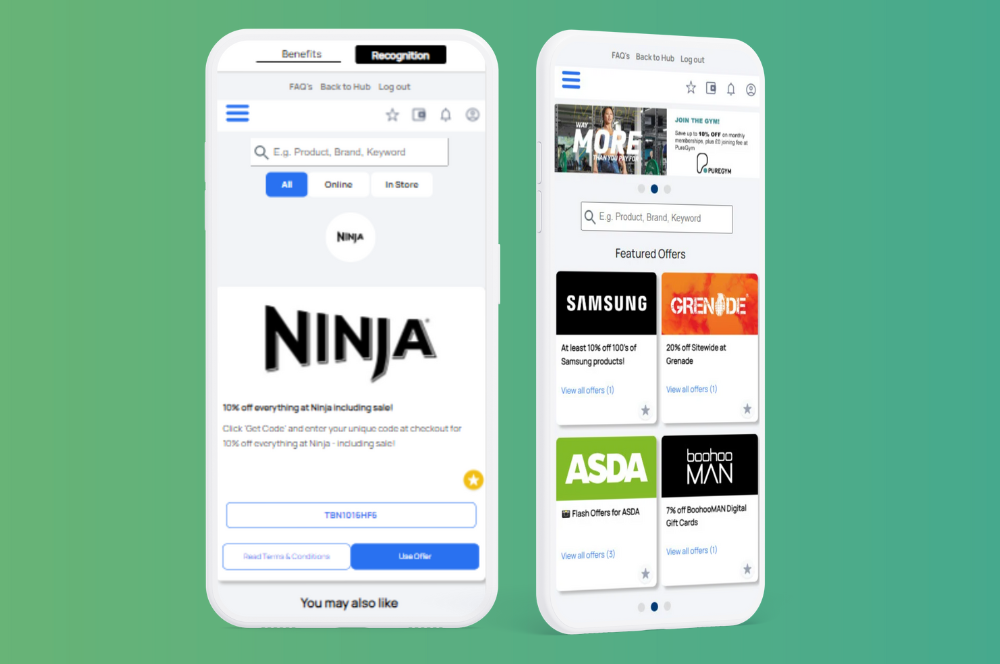

Discounts and Savings

Help your employees save up to £3000 per year on everyday spending with access to the top discounts and offers in the market. From groceries and restaurants to holidays and everyday travel, employees can start saving immediately with our employee benefits platform.

Reloadable Cards

Digital Gift Cards

In store & Online Discounts

On the Phone

Salary Sacrifice

A great employee benefits platform helps support your employees with their everyday finances and provides meaningful ways to save. Through Be Saving, you can access salary sacrifice schemes with some of the best benefit providers. Help your team thrive with our most popular schemes such as; Cycle to Work with Halfords, car benefits from Tusker and health plans from Klarity.

Cycle to Work

Green Car Scheme

Home and Electronics

Car Maintenance

You’re in great company

Be Engaged, Be Exceptional

Create an engaged, purpose–led organisation through the power of technology